CT600 Tax Return Forms

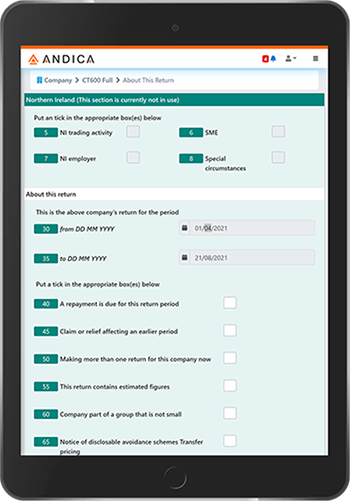

- CT600 – Company Tax Return form (Short and Full in version 2 and Full in version 3)

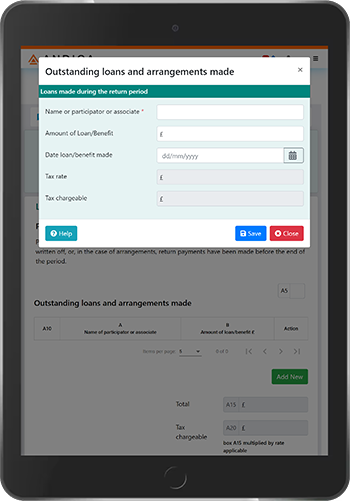

- CT600A – Loans to participators by close companies

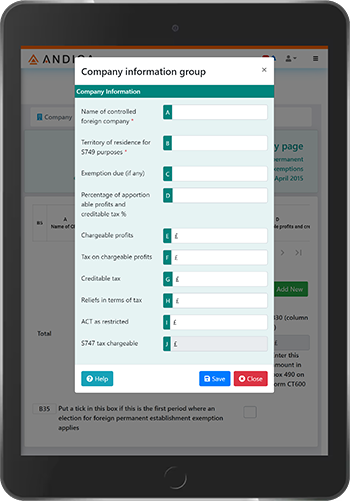

- CT600B – Controlled foreign companies (and Bank Levy)

- CT600C – Group and consortium

- CT600D – Insurance

- CT600E – Charities and Community Amateur Sports Clubs (CASCs)

- CT600F – Tonnage Tax

- CT600G (2006) – Corporate Venturing Scheme (version 2 only)

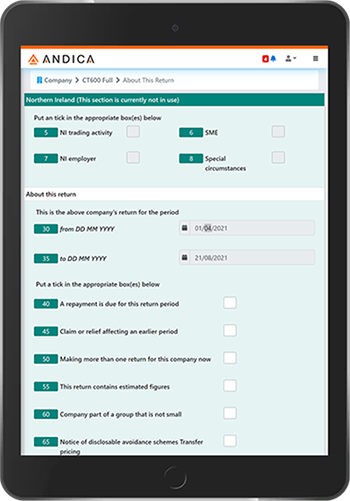

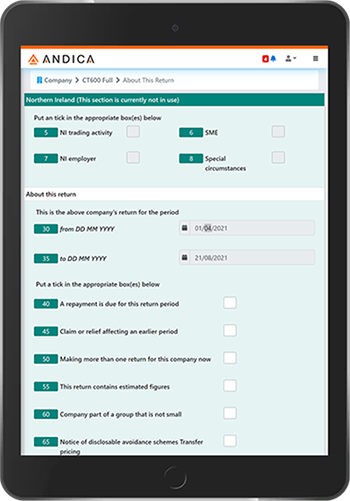

- CT600G (2018) – Northern Ireland (Not currently included, May be introduced later by HMRC)

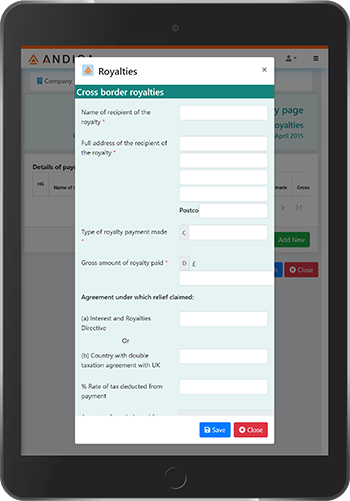

- CT600H – Cross-border Royalties

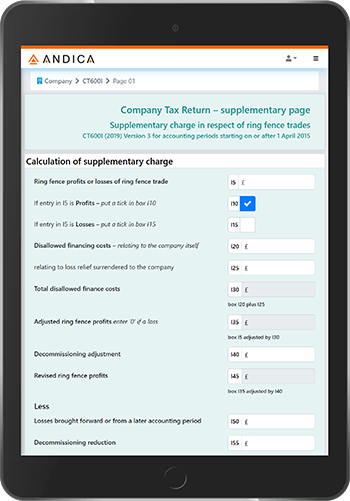

- CT600I – Supplementary charge in respect of ring fence trades

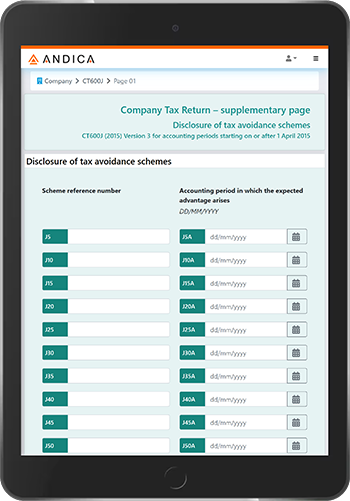

- CT600J – Disclosure of tax avoidance schemes

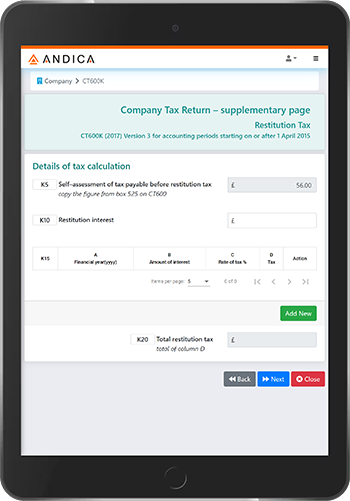

- CT600K – Restitution Tax (Introduced from 01/04/2017)

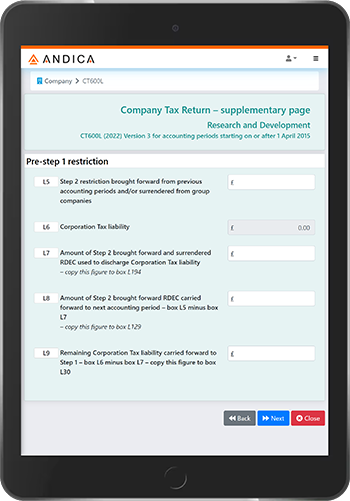

- CT600L – Research and Development

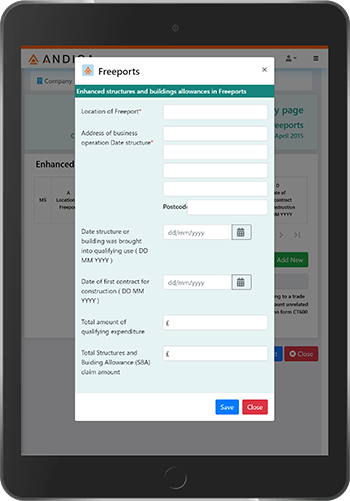

- CT600M – Freeports

- CT600N – Residential Property Developer Tax

Any relevant claims, elections, reports, or statements must be included. Different information, accounts, statements and reports, may be required from different descriptions of a company as, for example, is the case with insurance companies.

From 1 April 2011 onwards, all companies must deliver their Company Tax Return online for any accounting period ending after 31 March 2010. The computations and generally the accounts must be in Inline eXtensible Business Reporting Language (iXBRL). Andica CT600 Corporation Tax Software includes an in-built File By Internet feature.

HMRC have provided following Company tax return guide to form CT600 (2021) Version 3 for accounting periods starting on or after 1 April 2015 to assist Companies complete the Corporation tax returns. Further information can also be found on GOV.UK website.

Read More

An 'associate' of a participator includes any relative or partner of the participator and the trustees of any settlement of which the participator or their relative is, or was, a settlor(S448 CTA 2010, previously S417(3)(a) and (b) ICTA 1988). Methods by which a loan can be 'repaid' include depositing money into the company's bank account, crediting the participator's current or loan account with a dividend, director's remuneration or bonus, or book entry.

The term 'release' refers to a formal procedure that normally takes place under seal for a consideration, whereas 'write off' is a wider term that does not necessarily require formal arrangements and could include acceptance by the company that the loan will not be recovered and has given up attempts to recover it.

Read More

You need to complete the CT600B Controlled foreign companies supplementary section if at any time during the accounting period reported the company held a relevant interest of 25% or more in a foreign company which is controlled from the UK. No controlled foreign company (CFC) need be included on CT600B where it satisfies the Excluded Countries Regulations.

A UK company may also include companies which may not be CFCs but which would satisfy one of the exemptions if they were. This applies to foreign companies which may not be subject to a lower level of tax, or may not be controlled from the UK. It also applies where the UK company's relevant interest in the foreign company may be less than 25%. The purpose of this is to save UK companies the cost of working out whether a foreign company is in principle a CFC in cases where it is clear that one of the exemptions would be passed if it were.

Read More

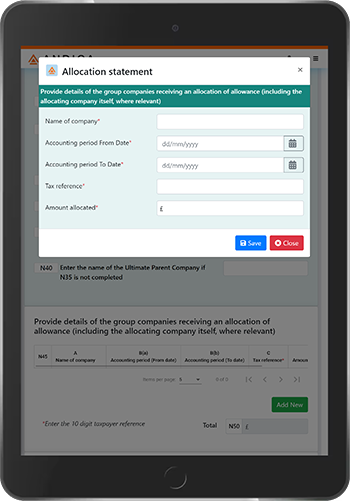

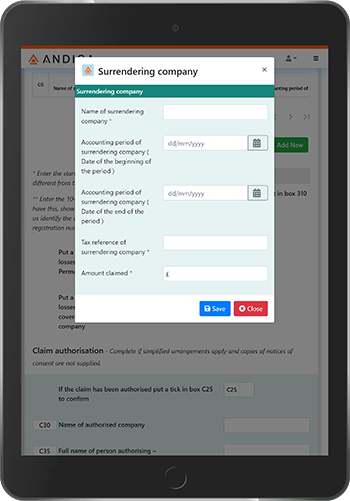

You need to complete a section of CT600C if the Company is claiming group relief in its calculation of corporation tax payable. You will need to provide a copy of each surrendering company's notice of consent to the claim. Include claims made under the consortium provisions and attach a copy of the notice of consent of each member of the consortium. If a simplified arrangement is in force, the claim may be authorised below.

HMRC have provided following Company tax return guide to form CT600 (2021) Version 3 for accounting periods starting on or after 1 April 2015 to assist Companies complete the Corporation tax returns. Further information can also be found on GOV.UK website.

Read More

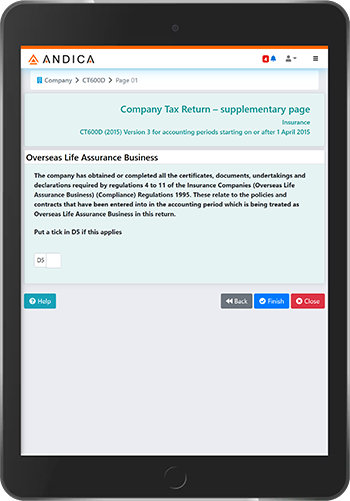

CT600D Insurance section must be completed by the insurance company, including a friendly society, has either entered into policies or contracts in the accounting period which it has treated as relating to overseas life assurance business (OLAB) in the accounting period, or has made claims under Sch 19AB ICTA 1988, to repayments or notional repayments for return periods ending within the accounting period.

The company has obtained or completed all the certificates, documents, undertakings and declarations required by regulations 4 to 11 of the Insurance Companies (Overseas Life Assurance Business) (Compliance) Regulations 1995 that relate to the policies and contracts it has entered into in the accounting period which it has treated as being OLAB in this return.

Read More

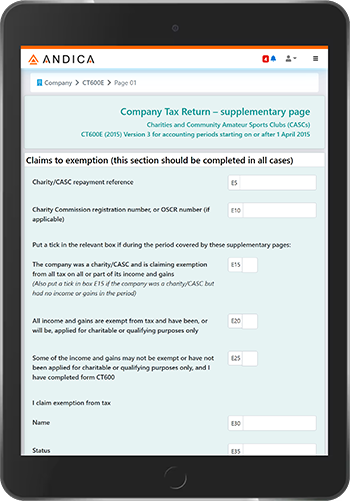

Charities and Community Amateur Sports Clubs (CASCs) need to complete CT600E supplementary section if the charity / CASC claims exemption from tax on all or any part of its income and gains. CT600E will form the charity's / CASC's claim to exemption from tax on the basis that its income and gains have been applied for charitable or qualifying purposes only. How often a charity or Community Amateur Sports Clubs (CASCs) are asked to make a return will depend on the extent and nature of its activities.

E15 The company was a charity/CASC and is claiming exemption from all tax on all or part of its income and gains. (Also put an ‘X’ in box E15 if the company was a charity/CASC but had no income or gains in the period) You must make an entry in this box and either box E20 or E25

Read More

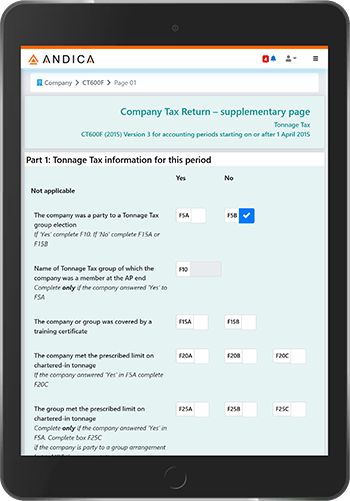

A company operating ships and electing for Tonnage Tax regime will also need to complete CT600F Tonnage Tax section.

Copy the figure from box F70 to box 200 of the form CT600. Include any figure from box F45 in box 450 of the form CT600.

Enter the name of the Tonnage Tax group of which the company was a member at the end of the accounting period. The qualifying companies in a group may nominate one group company to deal with those matters concerning Tonnage Tax that are more conveniently dealt with on a group-wide basis, including the 75% limit on chartered-in tonnage. Where a group wishes to make such an arrangement, all qualifying companies should jointly sign a letter nominating one of the companies as the representative company and specifying the matters that it will handle on behalf of the whole group.

Read More

Investment Relief on the amount subscribed for shares

Relief against income for losses on certain disposals of shares, whether effect is to be given to the claim in this period or an earlier period

Postponement of certain chargeable gains where the gains are reinvested in shares under the CVS.

Read More

Andica CT600 Corporation Tax software supports the HM Customs & Excise HMRC (formerly Inland Revenue) Corporation tax return forms CT600 Short and Full in version 2 and CT600 Full in version 3 with the most common supplementary forms you might need dependent on your circumstances.

HMRC's CT600 (2008) Version 2 forms are for accounting periods ending on or after 1 July 1999 and up to 31 March 2015.

HMRC's CT600 (2021) Version 3 forms are for accounting periods starting on or after 1 April 2015.

Read More

The company is a UK company and made cross-border royalty payments after 1 October 2002, and reasonably believed that the recipient of the royalties would be entitled to treaty relief on any tax deducted. The company is entitled to make such payments without deduction of tax or at the rate specified by reference to the Double Taxation Treaty appropriate to the country of residence of the payee.

The company is a UK company or UK permanent establishment of an EU company, and made royalty payments to an associated company in another Member State of the EU on or after 1 January 2004 (1 May 2004 for states joining the EU on that date) and reasonably believed that the beneficial owner of the royalties is exempt from UK Income Tax on those payments following the implementation of the Interest and Royalties Directive. Such payments should be made without deduction of tax.

Read More

You need to complete CT600I Tax Return Form for Supplementary charge in respect of ring fence trades section if for any period beginning (or deemed to have begun) on or after 17 April 2002 the company carried on a ring fence trade. You must complete these supplementary pages and form CT600.

A ring fence trade is defined at S502 and S492 ICTA 1988 and covers oil extraction activities and, or, the acquisition, enjoyment or exploitation of oil rights in the UK or a designated area. In practice this means all such onshore and offshore activities, to the outer edge of the UK Continental Shelf.

Read More

HMRC have provided following Company tax return guide to form CT600 (2021) Version 3 for accounting periods starting on or after 1 April 2015 to assist Companies complete the Corporation tax returns. Further information can also be found on GOV.UK website.

You are an employer and the notifiable arrangements concerned are arrangements connected with employment. A SRN for employment products should be notified separately using form AAG4

Read More

Restitution interest means profits in relation to which Conditions A to C below are met.

Condition A - is that the profits are interest paid or payable by the Commissioners in respect of a claim by the company for restitution with regard to either of the following matters (or alleged matters)

An amount deducted from an interest payment is treated for all purposes as paid by the company on account of the company’s liability. See S357YO CTA2010.

Read More

The legislation for Research and Development Expenditure Credit (RDEC) is found at Chapter 6A of Part 3 of the Corporation Tax At 2009 and the legislation for Research and Development Relief for Small and Medium Sized Enterprises (SME) is found in Part 13 of the Corporation Tax At 2009.

L10 - R&D expenditure on which RDEC is claimed in this accounting period (Insert the amount of expenditure which qualifies for RDEC during this accounting period and on which RDEC is claimed.)

L15 - RDEC claim for this accounting period (Insert the amount of the total RDEC claim before any discharges, surrenders etc.)

Read More

Freeports are special areas within the UK’s borders where different economic regulations apply.

Our Freeports model will include a comprehensive package of measures, comprising tax reliefs, customs, business rates retention, planning, regeneration, innovation and trade and investment support.

Read More

You need to complete these supplementary pages if you are recording an amount of RPDT in box 497 of the form CT600.

You are claiming or surrendering any amounts under the group and/or consortium relief provisions.

Read More