Andica CT600 Corporation Tax Cloud Application

Andica Corporation Tax Returns software helps to complete CT600 Company tax return form and submit it online to the HMRC. Limited companies and other organisations that are liable and are within the charge to Corporation Tax must file their CT returns each year and pay any tax that may be due.

Supports Multiple Accounting Periods

Current version of CT600 software supports multiple returns for accounting periods up to the date supported by the licence purchased. Accounting Periods must be created in chronological order. This is a limited time offer subject to licensing terms.

Annual Licence

The CT600 Cloud software is supplied on an annual licence basis. Annual licence is granted for use of software for a year effective from the date of purchase. Licence is granted for use of a specific version of the software and a new licence should be purchased for each version. In case of version upgrade, annual licence of the new version will supersede the earlier version. Software licence expires at the end of the term and the software with all its functions will be deactivated unless the licence has been renewed.

Multiple Companies

The software provides facilities for creation of multiple companies (subject to subscription). Software is aimed at Companies, Accountants and Tax Advisors. The software is available in multiple Company bands (of 1, 5, 25, 100 and Unlimited Companies).

Multi User Licence

The software supports ability for multiple users within an organization to access & use the software (subject to subscription).

Andica Corporation Tax software is iXBRL compliant and includes an option to record accounts and computation details in a set predefined structure from which iXBRL data is generated and submitted along with the CT600 submission. Alternatively, where you have a set of valid iXBRL accounts and computation files generated through another source, you can attach these to the CT600 returns and submit online to HMRC using the File By Internet feature.

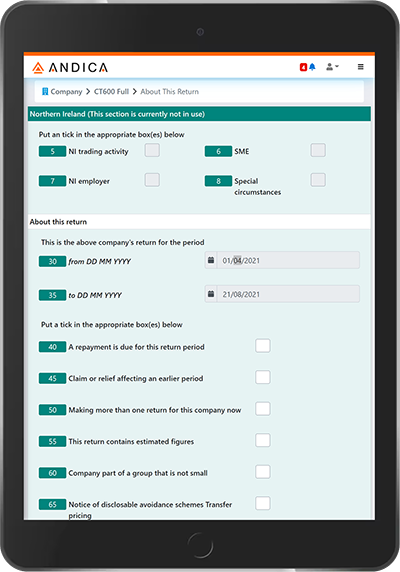

The CT600 Corporation Tax software includes CT600 and relevant supplementary forms as listed on the Features page. Data entry forms within the software are similar to HMRC forms, with some small variations, thus simplifying the form filling exercise. Tax calculations are performed automatically based on the Accounting Period for the returns.